With the continuous spread of coronavirus, the London stock market experienced a rollercoaster ride.

This is because the Organization for Economic Cooperation and Developments gave out warning signs that coronavirus might be the biggest threat to the world economy.

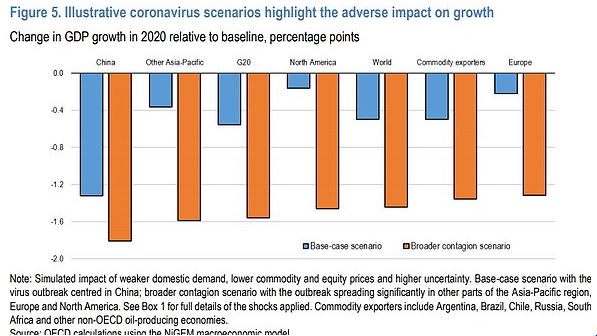

Some of the nations might enter the recession period and the world growth might be slashed down to half, if the virus spreads across Europe, Asia, and the US.

With such a slowdown, the world economy can only grow up to 1.5% this year, instead of 2.9%, which was previously forecasted this year.

The FTSE 100, which increases to 2.5% during the opening, was almost 1% at 6518, before that the recovering to trade was around 55 points on that day at 6636.

However, it eventually closed to 1.1% or 74 points at 6654 on Monday.

A massive decline of the growth prospects will also reduce the GPD growth to 1½% in 2020, and will ultimately push several countries to recession as well.

The impact on China will also intensify as it affects all the key export markets, along with the supplying economies.

If the situation doesn’t increase, with the epidemic increase in China during the first quarter, along with the outbreaks in other nations, then world growth will still be affected to a lesser extent.

Due to the spread of coronavirus, the UK’s economy was also slashed to 0.8%, where the previous forecast was estimated at 1.1%.

The Chinese economic growth was also expected to grow by 4.9% instead of 5.7%, and the US will grow by 1.9% instead of 2%, respectively.

OECD have urged all the banks and the government to fight back and avoid the steeper slump, which might take place through the outbreak.

The Bank of England has already made its decision and signaled that it would save the economy from the impact of the coronavirus outbreak.

Share this post with your friends and family.

Recommended Video:

“Vitiligo Sufferer Who Confused Condition For ‘bad Tan Lines’ Gets Tattoo Explaining Disease To Stop People Staring”

[rumble video_id=v5cdkl domain_id=u7nb2]

If you liked this post, we would love to hear from you:)