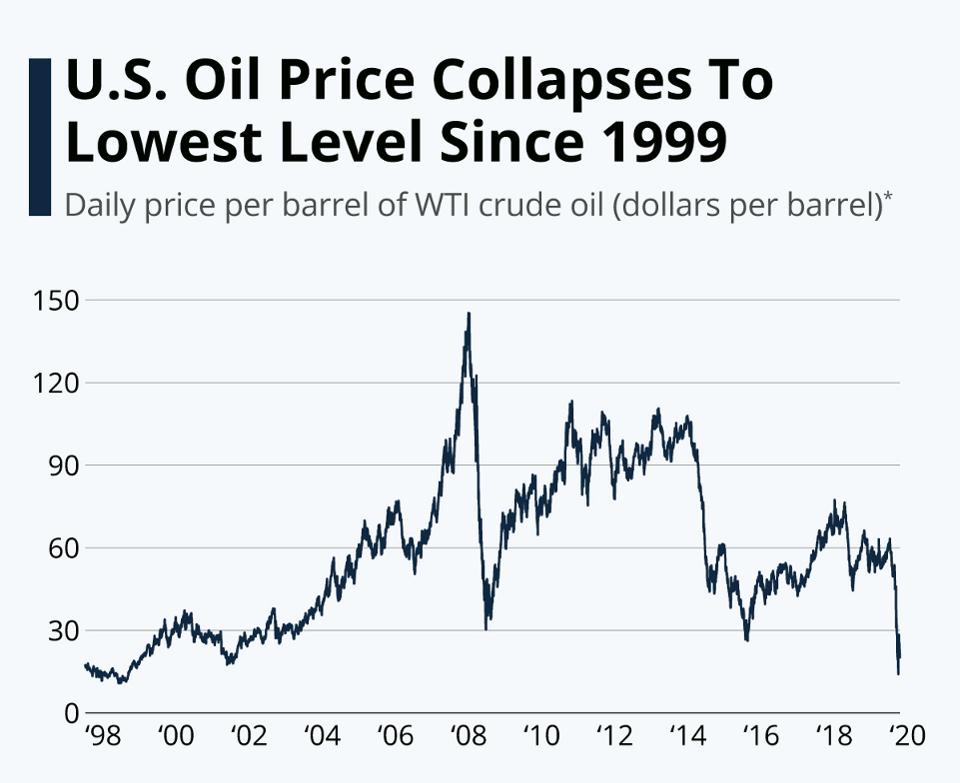

A historic fall of oil prices continues today as US oil prices fell to negative values. On Monday, US oil price was set at a staggering -$37.63 a barrel. It is the lowest recorded price since NYMEX became available for trade during the Reagan administration back in 1983.

Much like everything else in the news these days, the historical collapse can be attributed to the coronavirus. With almost all airplanes grounded and production lines around the line halted, there simply is little demand for oil. Running out of physical space to store the extra barrels, the producers had no other choice but to essentially dump oil into the market.

The big sell can also be explained by the mechanics of the oil industry. With the May contracts for West Texas Intermediate (WTI) nearing expiration, investors have decided to sell off what they have and focus on the June contracts.

As a result, June futures contract for WTI is set at a more respectable $22 per barrel. However, even that number is far lower than the historical average that can be seen in the chart above. Brent crudes are being traded t $25.81 today, 8% down. Brent is the global benchmark for global petroleum.

The investors are essentially playing a game of hot potato with oil barrels. Because of the effects of the global pandemic, no investor wishes to purchase oil in the short-term.

The chances of future shockwaves may not be too far according to some analysts. They point to the oil storage facilities that are quickly getting full of oil barrels. Many are especially worried about the consequences when the main oil hub of the US, located in Oklahoma, fills up.

Somewhat out of step, the global stock market has been recovering. In the last four weeks, US stock prices have risen for three weeks. Even in countries that either were struck hard by the pandemic or are still struggling with it, the stock market has recovered much of what was lost during the initial shock.

However, most analysts agree that it is too early to call how the market will move. They worry that the stocks have been recovering while most businesses and firms brace for an abysmal earning shock – a rare and potentially explosive diversion.

Share with us your thoughts in the comments and follow us on Facebook to keep up with the news.

Replaced!